Fewer resources, more revenue?

Changing the default from "more" to "efficient"

We've all been there. In the room or on the Zoom when we hear things like:

"We're behind on our target"

"Next year's goal is X% higher"

"What if we increased the ad budget?"

And the default reaction of everyone is almost always to do "more."

But what if "more" isn't actually better? I've seen this scenario play out time and time again, and savvy businesses are beginning to notice there’s a better solution to this problem.

Sponsor: HockeyStack

Your CEO just slacked you: "We have our board meeting in 2 days. Send me a slide with what's working + anything they need to know."

Did your palms get sweaty reading that?

Or is this an easy ask because you can easily get to this info already?

I'm neurotic about forecasting + tracking performance. I have reports upon reports and dashboards upon dashboards.

So when Emir + Claudia over at HockeyStack asked me what my perfect dashboard would look like, I immediately started geeking out.

And when they sent this dashboard mock-up back to me yesterday, I was in nerd heaven 🙌

2025 is underway. And it's also never too late to add some solid reports or views to your dashboard, so hopefully this provides some inspiration to any of you who are looking to level up your dashboarding game.

Doing more isn’t the answer…

This is a bandaid solution to the new acquisition revenue problem. It’s not going to fix it. It’s only masking it.

No matter how big the company gets. No matter how much the market changes. The problem isn’t going to go away if you treat it by trying to throw “more” at it. More headcount. More ad dollars. More resources.

Yes, your revenue line will grow, but your profit line probably won’t. In fact, it’ll most likely be staying the same, or even decreasing.

Why? Because few things scale linearly, especially when you’re talking about tens of thousands, millions, or even tens or hundreds of millions of dollars. The point of diminishing returns is a real thing. Market saturation is a real thing. The negative touchpoint is a real thing. So as you generate “more” at the top of the funnel, you’re also seeing higher acquisition costs and lower conversion rates.

AKA, your margins are getting worse.

…being efficient is

“Wow Sam, what a novel insight. This is only the same exact thing that I read literally every day on LinkedIn or hear on recent podcasts.”

I know, I know - this isn’t anything new. But I don’t think enough companies are truly internalizing this. Platitudes are shared from leadership that we need to “tighten up!” and “do more with less!”, but while they’re busy saying that their actions are showing the opposite as they continue to opt for the “more” route.

“Google Ads is getting too expensive and the cost per lead is increasing. Reallocate that spend over to LinkedIn lead gen ads - our cost per lead is much lower there!”

Sound familiar? Yeah, that’s what “more” looks like when it’s being masked as “efficient.”

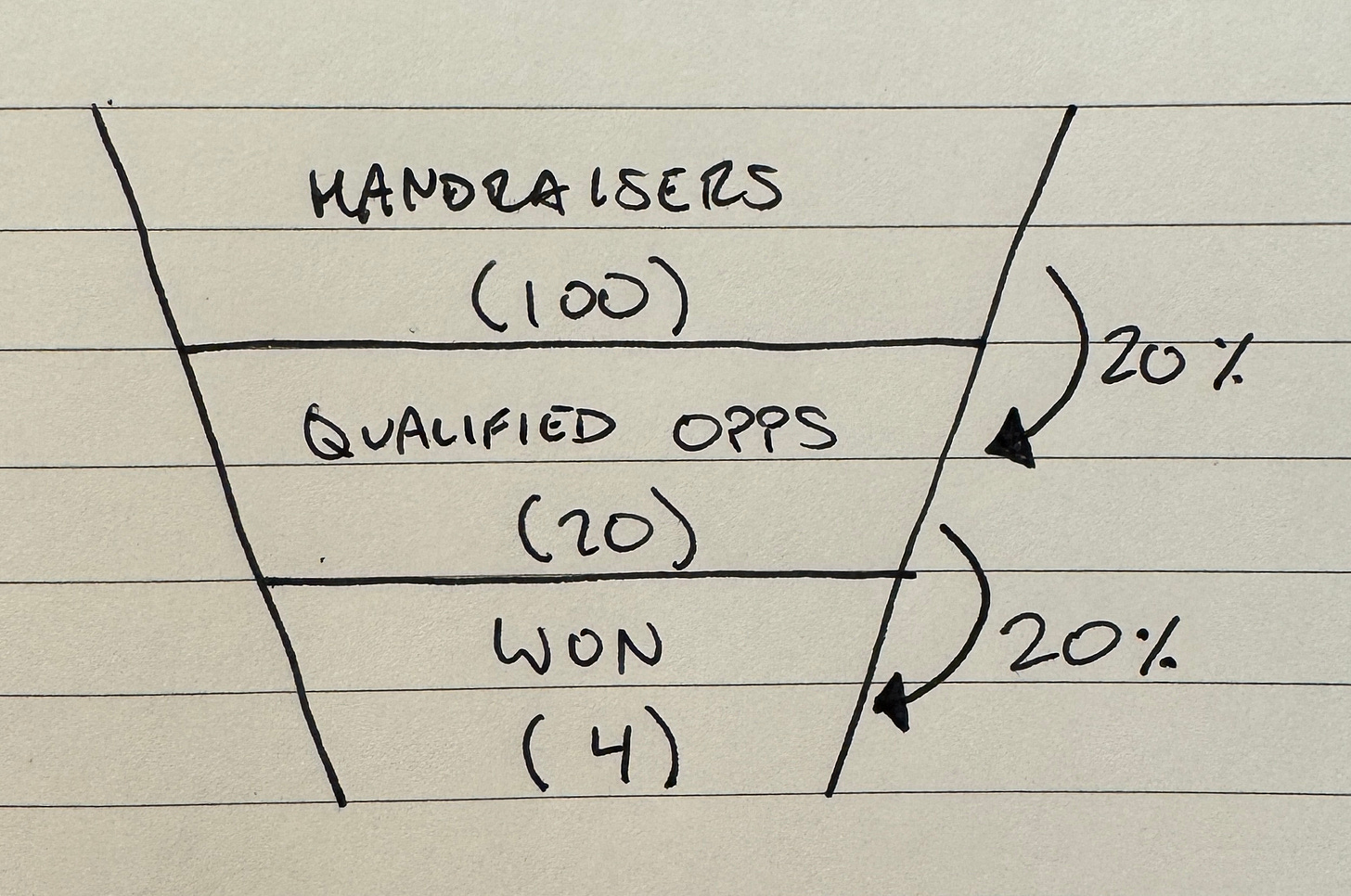

Here’s the deal. For the typical B2B company, they often have the following conversion rates:

20% handraiser to qualified opportunity rate

20% qualified opportunity to closed-won rate

Not terrible, but not that great either. If you generate 100 handraisers in a given time period, here’s how that plays out.

Meanwhile, efficient and effective GTM programs within B2B companies often have much stronger conversion rates, such as:

40-60% handraiser to qualified opportunity rate

25-33% qualified opportunity to closed-won rate

So what if instead of focusing on getting “more” at those same sub-optimal rates, we focused on being more efficient and effective with what’s already coming in?

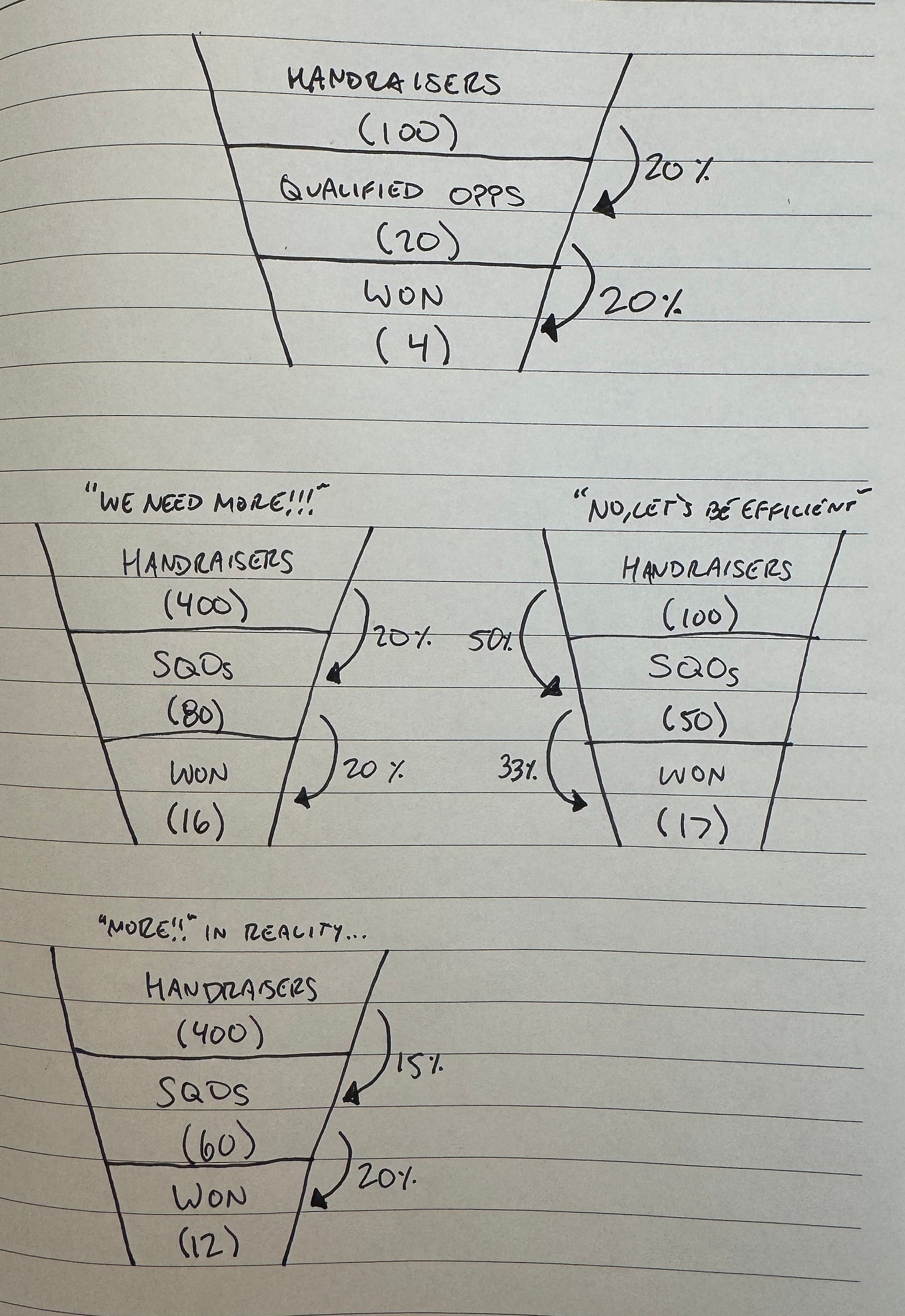

Let’s play this scenario out. The top funnel is what historicals have looked like. The left side is what happens if you go down the “more” path. The right side is what happens if you go down the “efficient” path.

For those of you not into numbers (or my 3rd grade doodles), here’s the TL;DR - we would need to 4x the “more” side to drive roughly the same amount of revenue as the “efficient” side does. And again, this doesn’t even scratch the surface of the profit margin conversation…

But because I’m a fan of really driving points home, I want to account for what I mentioned earlier on with how things don’t scale linearly when you get to this type of volume. Spoiler alert: the “more” side is about to look even worse.

Anddd just like that we lost 4 more closed won deals. When we go for more, we typically end up cutting corners or sacrificing quality for the sake of quantity. So in the example of moving from high-intent keywords in Google search to lower-intent Linkedin lead gen ads, yes, you’re going to get “more” leads no doubt, but the buying intent is lower than before. AKA, the conversion rate of those handraisers to qualified opportunities is going to take a hit.

So to bring it all together, here’s what your paths are going to look like:

In conclusion

Even if you QUADRUPLE the “more” scenario, it’s still not as impactful as being more efficient with the initial volume. Now I’m no math wiz, but if you’re telling me that my options are to either:

4x my spend/resources to only get a 3-4x return on that investment OR

Increase spend/resources by 1.5x (note: you usually have to invest some money into tech/automations or resourcing for process + frameworks) to get a 4x return on that investment

Well, I know which one I’m taking every time.

So next time you get that "we're behind, what can we do?" question, take a look at your conversion rates.

Instead of defaulting to the “more” option on the left, you might already have the volume you need at the top and just need to make sure you're making the most of it.

In case you missed these

New section here. I’ve been noticing a consistent decline over the past few quarters in the number of impressions the thoughts I share on LinkedIn are getting, despite the count of those following me increasing during that same timeframe.

Sorry to be the bearer of bad news, but as much as LinkedIn wants more TikTok-type video content as that’s where they’re pushing eyeballs, that’s just not my style.

So for any of you who follow me on there, but haven’t been seeing my content in recent months, I’m going to do a quick share here each week linking out to some of the posts + thoughts I’ve put out the past week on there.

See you next Saturday,

Sam