Un-blending and creating a disproportionate advantage

Post 2 of 3 in the Getting Leadership Buy-In series

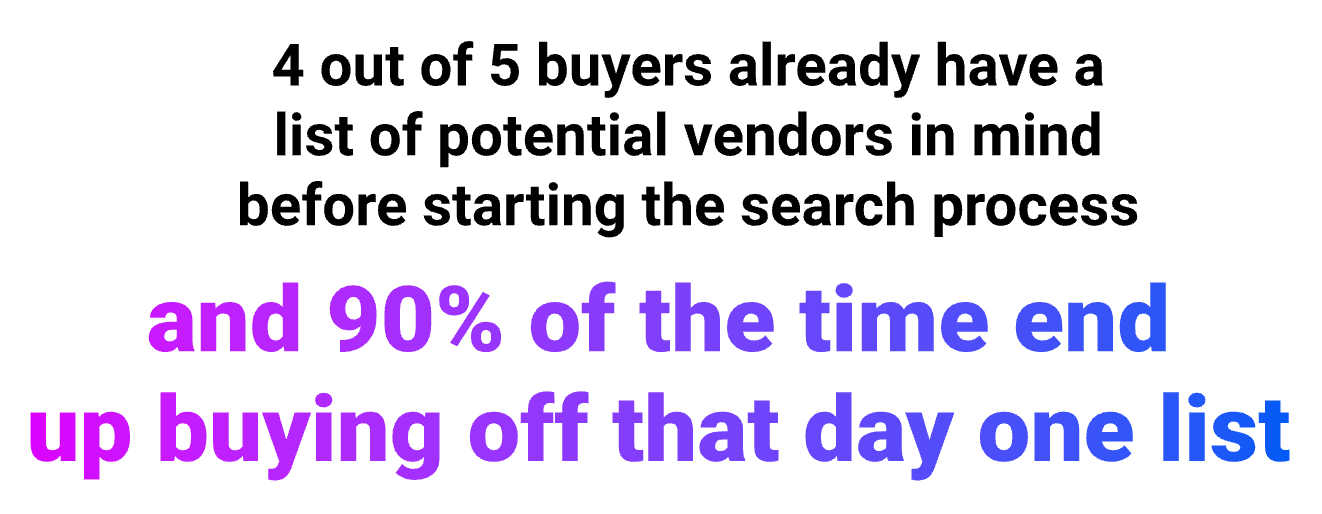

Fun fact: when a prospect officially enters “the buyer’s journey”, they aren’t starting from scratch.

More importantly, not every company gets an equal chance at winning that potential business. But why?

Simple: when a company finally recognizes that it’s time to solve for this pain or need to grow in a certain way, they already have a handful of companies in mind that can help them achieve this. A study conducted by Bain and Google in 2022 highlighted the massive insight that 9 out of 10 B2B purchases that are made go with a vendor they already had in mind before officially starting the “traditional” buyer’s journey.

Think about it - information is EVERYWHERE and very easily accessible now. Rewind 20, 30, even 40 years ago, and that information could only be acquired through an RFP, at an event, by having the provider “call” on you or, even scarier, faxed to you 😱. AKA, sellers had all the power.

Now fast forward back to today and you’re only ever a search query, conversation, podcast, video, etc. away from getting the information you were seeking. And if the seller doesn’t provide that information easily or transparently, the prospect simply finds another alternative (aka one of your competitors) that has that information readily available for them. AKA, buyers now have the power.

So now it’s up to you to help your leadership team understand this shift in power dynamics and position your company in a way that will help you succeed moving forward.

Data, data, and some more data

I love data. I could geek out on data all day long.

More specifically, I love to use data to support what we should AND shouldn’t be doing. And that’s exactly what we’re going to do here with the leadership team.

Instead of blindly guessing at what we should be doing, following the current “best practice”, or mirroring what our competitors are doing, let’s use our own data to inform what we should do.

To blend or not to blend, that is the question

If Shakespeare was a marketer in 2024, I fully believe he would’ve asked his leadership team that question.

Most companies use a “blended” story for each team (and sometimes even the entire company 😅):

Marketing produced X at Y%, generating $Z.ZZ return

Sales produced A at B%, generating $C.CC return

The problem with this approach is that you’re using an average of a series of averages. This is a BIG no-no. And this plays into exactly what we should be doing - looking at the full story to understand what’s going on.

So that means taking the Marketing “bucket” and breaking it down by the core channels, such as:

Lead gen (think: gated ebooks, LinkedIn lead gen forms, etc.)

Inbound (think: user comes to your “demo request” page and voluntarily fills it out as they want to learn about the product/service)

Partner/Reseller

Events

Etc.

I’m going to keep it simple here and focus on the first two, but you can and should do this for as many channels that you currently use or historically used.

Alright, so now we’ve broken the Marketing “bucket” down into core channels. The above two are normally the biggest buckets, but I left out 250 “leads” as the above does not represent all of the channels that fall into the marketing bucket.

This is where the fun begins as you’re now able to see how the different channels play out for driving new business. And this is where you’ll likely start to see some questions like these in the yellow text boxes come up from the leadership team:

Lightbulb moment initiated

Congratulations, you’ve now shown that not all marketing efforts and channels are equal at driving new business. The strategy and tactics you use will all play out differently not just based on a binary yes/no if you use certain channels, but will vary based on the investment level in each, how well they’re executed, and so on.

The above example is VERY common. So common in fact, that this problem is exactly what we built Refine Labs on during my previous time there (S/O to Chris Walker + Megan Bowen for evangelizing this approach). With this data, you are able to show your leadership team exactly how your current marketing strategy + channels are (or aren’t) performing.

If you continue to focus on lead gen, you’ll simply see the above lead gen results on a larger (read: inefficient) scale.

But if you focused more on inbound, what would that look like with 2x, 3x, or 5x the resources applied? The beauty is they don’t need to be net new resources, but can be reallocated from lead gen, meaning you spend the same amount, but each dollar goes drastically farther in driving qualified pipeline and future revenue.

Now what?

You now have the attention of your leadership team. The next two questions they’re going to ask are:

What would it look like to make this shift?

When should we expect to see these new + improved results?

Stay tuned for part 3 of 3 next week where we’ll get into setting expectations with them and how to set yourself up for success with this new strategy.

One LinkedIn post I bookmarked this week

Ok, so this one may be cheating just a little bit, BUT since I found out about it through LinkedIn, I’m ok with it.

Lucid Chart + their TikTok video campaign hilariously diagramming different animals has had me rolling on the ground laughing. Absolutely BRILLIANT in so many ways.

Shows their product in action

Beyond funny + has me watching the entire video AND then wanting to see more like it

Perfectly marries content + message + channel + medium —> AKA the holy QUADFECTA

Go enjoy all the goodness on their TikTok account here: https://www.tiktok.com/@lucid_software

(I’m not affiliated with Lucid Software in any way, just think this entire series is too good not to share)

One podcast episode I enjoyed this week

Loxo is in the recruiting software business. Jason Fried, David Heinemeier Hansson, and 37signals are in the calling a spade a spade project management business. They’re constantly sharing the things that many of us think, but instead of simply thinking them, they put their money where their mouths are and back up their talk with action.

So that is exactly why I loved this recent episode of Rework where they shared thoughts about all things hiring. A few parts of the conversation I especially enjoyed:

If you could only hire people on yearly contracts, after one year, would you hire them again?

Calling out that 50% of bad applicants are simply a result of them not reading the job description and recognizing not only if they’re qualified, but what the job actually entails

Resumes are fluffy highlight reels, but the cover letter is where you can truly differentiate and stand out

Using interviews to see if the candidate has the ability to get into the details/specifics, or if they only know how to stay high-level

Although only about a 30 min episode, whether you’re on the hiring or interviewing side of the coin, this episode will definitely give you a new way to approach this process.

And for anyone interested, here’s a playlist I add to each week with some of my favorite podcast episodes:

See you next week,

Sam

First off, I'm in love with the clip clops...the farmer in me just kept laughing and wanted to do one for cows. Ok now for the meat of the newsletter: I completely get what you did for simplicity, I just always want to go further. I can't stand the overall approach (not what you did just hear me out) as what most then try to do is your typical Sirus Decisions funnel and turn your chart on it's side and say "here's your conversion rates." Hard pass...are those leads unique? Are they also unique per account? Furthermore, take inbound as an example...that's truly only part of the story. So you know that people want a demo or whatever to learn. Fantastic, but what I truly want to know is how did they get there? It's basically the "creation vs capture" notion, I can't reallocate budget appropriately to invest more to obtain more opps that convert at a higher rate without this info. See, I told you I always want to dig further. :)